Every business owner, freelancer, or employee understands the importance of having accurate financial documentation. This necessity extends across all industries and professional roles, playing a vital part in maintaining clarity and transparency in financial matters. Whether it’s for securing a loan, managing taxes, or simply keeping a personal record, accurate financial documentation is essential for maintaining trust and ensuring smooth transactions. In particular, pay stubs serve as a crucial piece of paperwork that provides a clear summary of one’s earnings, taxes, and deductions. These concise records are essential for employees to understand their net earnings and for employers to maintain proper financial records. The format of pay stubs can vary, but they usually include details like gross wages, federal and state taxes, social security, Medicare, and other deductions. For many, this document not only serves as a proof of income but also as a tool for financial planning and budgeting.

In particular, pay stubs serve as a crucial piece of paperwork that provides a clear summary of one’s earnings, taxes, and deductions. These concise records are essential for employees to understand their net earnings and for employers to maintain proper financial records. The format of pay stubs can vary, but they usually include details like gross wages, federal and state taxes, social security, Medicare, and other deductions. For many, this document not only serves as a proof of income but also as a tool for financial planning and budgeting.

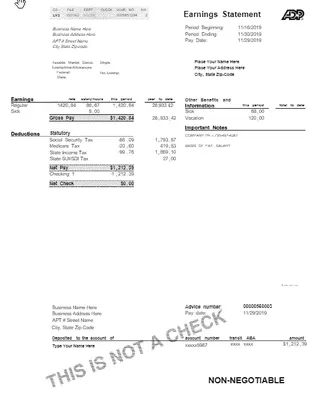

The ADP Pay Stub Generator, with its ability to create customizable pay stubs using free pay stub templates, is a helpful resource that delivers professional-looking and authentic pay stubs. Its user-friendly interface allows businesses and individuals to produce pay stubs with ease, catering to specific needs and compliance requirements. This tool significantly simplifies the process of pay stub creation, saving time, reducing errors, and enhancing the professionalism of this important financial document. Whether for a small business owner or a large corporation, the ADP Pay Stub Generator provides a reliable solution to a common financial need.

[toc]

Facts about the ADP PayStub Generator template

According to thebalancecareers.com: “A paycheck is a check issued by an employer in order to satisfy the compensation commitment the employer made with the employee when the employee was hired. The paycheck is usually issued every two weeks, although some employers issue paychecks weekly or monthly. Check out our ADP Paystub generator and our Custom Pay Stubs templates.

Salaried or exempt employees generally receive 26 paychecks a year, with compensation paid in equal installments. In an all-salaried organization, time recording or time clocks are rarely required. The assumption is that every employee is earning the salary that they are being paid.

What is an ADP PayStub Generator?

Create Your Custom Pay Stubs

What is an ADP PayStub Generator? An ADP PayStub Generator is a unique tool designed to create simulated or fake pay stubs that resemble those issued by the well-known payroll company ADP. These pay stubs can be used for various novelty purposes and are crafted to look like legitimate documents, but it’s essential to understand that they are not actually issued by ADP or any real employer. The generated pay stubs are meant to be used for entertainment or demonstration purposes, rather than for any serious financial transactions.

Create Your Custom Pay Stubs using the PDFSimpli specialized tool. With the ability to emulate details like wages, taxes, address, employee name, employer’s name, deductions, and more, the ADP fake pay stub copy is a versatile novelty item. This software’s customization options allow users to adjust various aspects of the pay stub, ensuring that it matches their specific needs or desires. Whether for use in a presentation, as a prop, or for personal amusement, our Pay Stub Generator Software offers the best experience in creating realistic pay stub copies.

Does this Bank Statement Look real?

This fake Pay Stub copy looks as real as it gets. See for yourself, click on the top of the page button to view and edit this ADP Pay Stub template from PDFSimpli as much as you like. You can tailor the wage as much as you like, the tax information, the address, and dates of payments, and anything else you need with this awesome tool. Once again, PDFSimpli does not endorse the use of this free Pay Stub template for any illicit or illegal activity.

What Are the Components of an ADP Pay Stub?

PDFSimpli’s ADP Pay Stub generator template includes all the essential components required to create a comprehensive and accurate pay stub for employees. Some key components include:

- Employee Information: Personal details of the employee, such as name, address, and social security number, are included for identification purposes.

- Earnings: The pay stub lists all sources of income, including regular wages, overtime pay, commissions, bonuses, and other forms of compensation.

- Taxes Withheld: It includes federal, state, and local taxes withheld from the employee’s earnings, along with Social Security and Medicare contributions.

- Deductions: This section provides a breakdown of various deductions made from the employee’s gross pay, such as healthcare premiums, retirement contributions, and other voluntary deductions.

- Net Pay: The pay stub displays the final amount the employee will receive as take-home pay after all deductions and taxes have been subtracted from their gross earnings.

Best Uses for this Free Pay Stub Template from PDFSimpli

The ADP Pay Stub Copy Generator from PDFSimpli is a reliable and cost-effective solution for creating accurate paycheck stubs. It eliminates the risk of creating a fake pay stub and ensures that employees receive an official document reflecting their earnings and deductions. The generator uses the ADP Pay Stub Template standard format that complies with the requirements of most landlords.

The PDFSimpli tool is also useful for those who are looking for a free pay stub template. Users can easily access the generator and create a customized paycheck stub that accurately reflects their earnings and deductions. The generated document can be downloaded and printed in a matter of minutes, making it an ideal solution for individuals and businesses looking for a quick and hassle-free way to create a pay stub. By using this stub copy generator, users can avoid the risk of creating a fake looking pay stub and ensure that their financial records are accurate and up-to-date.

Other Uses include:

- Employment verification: In an era where contractual, part-time, and freelance roles are becoming more common, being able to verify one’s employment and income is crucial. These pay stub templates offer a credible way for individuals to confirm their earnings, whether for potential employers, landlords, or financial institutions.

- Loan applications: are another area where the free pay stub template shines. Lenders require concrete evidence of an applicant’s income, and these templates provide that evidence in a clear, easy-to-read format that lenders appreciate.

- Rental applications: Landlords often require proof of income before leasing their property. Providing a pay stub generated from this free template gives them a straightforward understanding of the applicant’s financial stability.

I need a Pay Stub that looks like one from ADP, is PDFSimpli the right place?

Check our Custom Pay Stubs

PDFSimpli has put together this Paystub Template tailored to look like the ones from ADP, ensuring users have an authentic feel and professional appearance to their generated pay stubs. Recognizing the diverse needs of individuals and businesses, we’ve designed it with customization in mind. You are free to edit this Pay Stub as much as you like, making it uniquely yours. Whether you want to adjust the overall layout, change the font sizes, or even add specific logos, our online editor tools have got you covered. Moreover, if you have other documentation needs, you can also explore and personalize any of our other form templates. The whole Pay Stub is at your fingertips for editing. You can modify each section, input unique data, or incorporate any necessary details you would like to include, ensuring that the end result aligns perfectly with your requirements.

This flexibility isn’t just about appearance; it’s about functionality and usability across various scenarios. Whether you’re a small business owner who wants to provide employees with professional-looking pay stubs, an educator demonstrating payroll documentation to students, or an individual experimenting with financial planning, the customization options are tailored to meet various needs.

With PDFSimpli’s ADP-like Paystub Template, you can create a document that adheres to industry standards while allowing for personalized touches. Add or remove sections as needed, insert specific notes or disclaimers, or even adjust the color scheme to align with a company’s branding. Our template doesn’t only mimic the look of an ADP pay stub; it offers a user-friendly experience that makes it easy for anyone to create a convincing pay stub in just a few minutes.

Moreover, for those concerned about accuracy, our Paystub Template is designed to reflect real-world calculations. You can input specific figures for earnings, taxes, deductions, and other financial details, and the template will display them in a manner consistent with actual pay stubs. This makes it an excellent tool not just for novelty or demonstration purposes, but also for real-world applications where an authentic-looking pay stub is needed.

And don’t worry about technical hurdles; ourPDFSimpli online editor tools are designed to be accessible to users of all skill levels. With intuitive controls and clear guidance, you can modify the Pay Stub without any specialized knowledge or expertise. Plus, our customer support is always ready to assist you with any questions or challenges you may encounter.

So why wait? Dive into customization, explore the possibilities, and create a pay stub that’s not only professional-looking but also tailored to your specific needs and preferences. With PDFSimpli’s Paystub Template, you have a powerful tool that offers both authenticity and flexibility at your fingertips.

Conclusion:

PDFSimpli’s ADP-like Paystub Template is more than just a tool for generating pay stubs; it’s a comprehensive solution that addresses various professional and personal needs. Tailored to resemble genuine ADP pay stubs, it not only brings authenticity but offers a host of benefits that make it indispensable in today’s dynamic environment.

Top 5 Benefits of using our ADP pay stub template:

- Customization and Professionalism: With an array of customization options, users can craft pay stubs that not only look professional but are aligned with their unique needs and branding. Whether it’s altering the layout, adding specific logos, or adjusting the color scheme, this template allows for a tailored experience.

- Versatility across Various Scenarios: From small business owners needing official documentation to educators teaching payroll concepts, the template’s versatility ensures it caters to various requirements. Its authenticity makes it suitable for real-world applications like loan and rental applications, employment verification, and more.

- Accuracy and Compliance: Designed to reflect real-world calculations, this template ensures accuracy in displaying financial details. By adhering to industry standards, it offers compliance assurance, eliminating the risk of fake-looking pay stubs and providing credibility.

- Ease of Use: Its user-friendly interface encourages users of all skill levels to effortlessly create convincing pay stubs. With intuitive controls, clear guidance, and customer support, the process becomes accessible and hassle-free.

- Cost-Effective Solution: PDFSimpli’s ADP-like Paystub Template offers a free and accessible tool for creating professional pay stubs, eliminating the need for expensive software or specialized services. Its user-friendly interface translates into time and cost savings for both individuals and businesses. This template stands as a budget-friendly solution that doesn’t compromise on quality, providing a practical and economical approach to financial documentation.

10 Top Frequently Asked Questions about ADP Pay-Stub Template:

Can I use the ADP Paystub Template for loan or rental applications?

Absolutely! PDFSimpli’s ADP-like Paystub Template is perfect for creating authentic-looking pay stubs suitable for loan or rental applications. Access user-friendly tools and start creating your pay stub now!

What is an ADP Paystub Template, and how can I create one?

An ADP Paystub Template is a standardized format used to create pay stubs that resemble those issued by ADP. With PDFSimpli’s Paystub Template, you can create customized ADP-like pay stubs effortlessly. Explore a wide variety of forms or start crafting your professional pay stub on the PDFSimpli website.

Is it possible to create an environmentally friendly pay stub using an ADP Paystub Template?

Yes, by using PDFSimpli’s online ADP-like Paystub Template, you contribute to a paperless approach, aligning with sustainable practices. Create your eco-friendly pay stub today!

How can I customize an ADP Paystub Template for my employees?

Customizing an ADP Paystub Template is simple with PDFSimpli’s PDF Editor. You can modify details like wages, taxes, deductions, and more to align with your business needs, all within an easy-to-use interface.

Is there a tool to generate an ADP-like pay stub for demonstration purposes?

Yes, PDFSimpli offers a unique Paystub Template designed for creating ADP-like pay stubs for demonstration or novelty purposes. Create your custom pay stub today!

Can I trust the ADP Paystub Template for my financial documentation needs?

Absolutely! PDFSimpli’s ADP-like Paystub Template is designed to reflect real-world calculations, providing trust and authenticity in your financial documents. Whether for individual or business needs, PDFSimpli’s PDF Editor offers powerful tools to create, edit, and manage all your PDFs with confidence.

What is the easiest way to create a professional banking pay stub?

Creating a professional banking pay stub is easy and convenient with PDFSimpli’s Pay Stubs templates. Simply input your details, and the template will handle the rest, providing an authentic and compliant pay stub.

How can I create an authentic-looking bank statement for demonstration purposes?

PDFSimpli provides user-friendly templates for creating bank statements that look authentic and professional. Whether for a presentation, demonstration, or personal use, these templates offer a simple and reliable solution.

Are there customizable templates available for financial documents like bank statements and pay stubs?

Absolutely! PDFSimpli offers customizable templates specifically designed for various financial documents, including bank statements and pay stubs. You can find a comprehensive collection of these financial templates here.

How do I ensure the privacy of my financial information while using an online banking template?

PDFSimpli prioritizes user privacy and ensures that your financial information is kept secure. By utilizing secure SSL connections and adhering to strict privacy policies, you can confidently create and manage your financial documents with peace of mind.