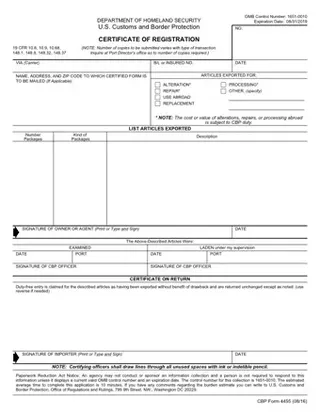

Facts about the CBP 4455 PDF template

[toc] Do you have an old clock that broke unexpectedly and needs the specialized repairs of a clock maker artisan in Germany? Or perhaps you will be traveling overseas with an expensive foreign laptop and want to make sure that you will not be hit with extraneous fees when you come back to the US? If that is the case, you will need to fill out a CBP Form 4455.

What is the CBP form 4455 PDF used for?

A CBP 4455 form is a Customs and Border Protection form used to register and defer duty payments on items which will be exported temporarily and subsequently returned to the U.S. One use for the form is to certify prior personal ownership of high value items before traveling out of the country. Without the form, the item could be viewed as an import and would then be taxed as such. Another use for the form according to the U.S. Customs and Border Protection Agency the main purpose of the CBP 4455 form is “To avoid paying customs duties on foreign-made merchandise sent abroad for repairs and/or alterations”. Without the form, anyone sending a foreign made item abroad for repair could face a duty tax on the item when it comes back to the U.S. In more simple terms, the form provides proof that the item was previously owned in the U.S. and as such, the import duty taxes have already been paid. However, it is important to note here that “costs of any foreign alterations, repairs, or processing of the goods if applicable are subject to customs duties on return of the goods to the U.S.”– meaning that any repairs done on the items may end up being charged a custom duty, although not a duty as large as one for the entire item.

Who Would Use the CBP Form 4455 PDF?

There are two main types of people who would use a CBP 4455 form. The first type would be either be taking an extended vacation out of the country or would travel frequently. They would use the CBP 4455 form to certify that all of their expensive foreign-made possessions were either purchased in the U.S. or that their import duties were paid previously. This person would, use the CBP Form to certify that they already owned their possessions and that they are not trying to import each one. The second type of person to use the form would have a foreign-made object that needed to be sent out of the country for specialized repairs. By using the form, they are avoiding paying duties on the item itself and will only have to pay any fees on the alterations or repairs done to the item.

When Should You Use the CBP form 4455 PDF?

According to the official CBP website, the CBP 4455 form should be used “When exporting goods purchased overseas for repair, alteration, processing, replacement, exchange, upgrade, or for use abroad, it is recommended that the exporter fill out a CBP 4455 Certificate of Registration and include a copy with the shipment.” Fortunately, there is no deadlines associated with the form, it just must be filled out and given to a Customs and Border Protection agent or, if the item is being mailed, it must be placed inside the package in an easily accessible spot. If the item in question is under warranty, the overseas supplier much indicate in on an invoice and then also include the invoice in the package. If the item is being exchanged, upgraded, or replaced and the value of the goods is more than the original purchase, the invoice must also indicate the price difference between the original item and the new item.

Don't have a resume yet? Use ResumeBuild to build a professional resume in minutes!

What are the Consequences for not Using a CBP Form 4455 PDF?

Not using a CBP 4455 would mean that there would be no duties on goods sent out

of the country for repair. The consequences of that would be that the item is taxed in full upon its arrival back in the U.S. instead of only being taxed on the repairs or alterations made on it.

Steps for Filling Out a CBP Form 4455 PDF

1. Fill out the carrier name, insurance number, and the current date.

2. Fill out the name and address of the owner of the goods if they are to be mailed.

3. Check the appropriate box if the goods are to be altered, used abroad, repaired, or replaced. If none of those apply then check the “Other” box and specify on the lines what the goods are being sent out of the country for.

4. Write the number of packages being sent, the kind of packages they are, and a description of the goods in each package. If multiple packages are being sent, list them one below the other in the “List of Articles Exported” section.

5. Have the owner of the goods sign below the “List of Articles Exported”

6. If taking the goods with you on a personal trip out of the country, keep the form with you and have a customs agent sign it at the border. If they are being mailed out, place the form in an easily accessible spot inside the box the packages are being sent in. If multiple boxes are being mailed, be sure to include a form inside each one.