Facts about the Check Stub Template Printables PDF template

[toc] Free printables forms are a convenient way to provide paystubs. When employees are paid, they need to receive a paystub, which serves as the receipt for their . The stub also serves the crucial purpose of listing the gross pay and the net pay, with a detailed list of . The paystub also serves as proof that the was made to the party because it indicates the , number, and address of the recipient. This also referred to as a can be edited online with PDFSimpli’s . Here you will find that can be edited as you like. You have a and have the opportunity to enter data such as , gross pay, payments, , information, information and or other retentions.

Why is the free check stub template printables used?

Employers use the free check stub templates for convenience and efficiency in completing payroll duties. As every employer knows, making payroll is essential to the success of his or her business. It can also become an expensive and time-consuming process.

When processing payroll, employers must divide employee salaries into the pay period. For hourly employees, the employer must have a record of the hours that the employee worked during the pay period. Using its record of the employee’s pay rate and time, the employer determines the gross pay due to the employee.

Employers must then calculate deductions from each employee’s paycheck. Standard deductions include all required tax withholding. In the case of 1099 workers, the employer simply uses the gross amount because independent contractors pay taxes on their own. Employers must also deduct health insurance premiums and other miscellaneous deductions.

To create a record and for legal compliance, employers must provide a written document showing gross pay, net pay, and all deductions. The free fillable PDF paycheck stub form fulfills these business and legal requirements. By following the steps indicated on the form and completing each field, the employer fulfills obligations to the business, employee, the accounting department, as well as the labor department and Internal Revenue Service (IRS).

Who would use a free check stub template printables PDF?

Managers, business owners, accountants, and others who are responsible for paying either employees or independent contractors use the form to create professional, legally binding records of payment. For W2 employees, employers also use the form for compliance with IRS regulations, as well as compliance with any other government agencies that require the employer to perform certain deductions. For 1099 workers, the free check stub template creates a record of payment, which is required by the IRS.

The template provides an easy to use a format where all information can be directly inputted into the fields. For example, the template has spaces for gross pay, net pay, and deductions. If a field does not apply, it can be left blank. The template provides space for the addition of any necessary deductions. As not all employees have the same number of required deductions, the employer is able to add in the number of deductions needed for the individual. The employees identifying information is included so that the free check stub template creates a legally binding document.

What are the consequences of not using free check stub template printables?

Failing to create check stubs has serious repercussions for any business. First, an employer must document payment. Without a check stub, the employer has no proof that payment was made. If the payment is ever questioned by the employee or if a complaint or lawsuit is filed by the Department of Labor, the employer needs the paycheck stub to prove it made payments required by law.

The IRS requires that employers perform certain deductions. In some cases, other government agencies may also require deductions. Failure to document compliance with these requirements can lead to serious consequences, including fines. Additionally, an employer must have paycheck stub records in case of an audit. A tax audit, for example, will require the production of these documents. Failure to produce them can lead to legal problems.

Steps to filling out free check stub template printables

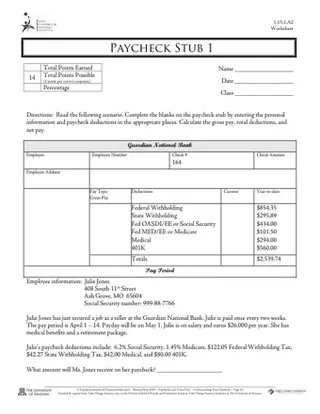

- Read the example scenario. This scenario shows the information that needs to be gathered for completing the form. For example, to complete the form, you must have the employee’s name, social security number, pay rate, amount worked during the pay period, etc.

- Determine the employee’s gross pay.

- Determine the number and amount of deductions that apply to the employee. For example, the standard deductions are Social Security, Medicare, federal withholding, and state withholding. Employees may have additional deductions for benefits, such as medical insurance, dental insurance, and life insurance. There may also be expense deductions, such as uniform expenses. Some employees have additional deductions, such as child support payments or wage garnishments.

- Subtract deductions from gross pay. This leaves the amount the employee receives on his or her check. This amount is entered at the bottom of the form.

- Fill in all necessary fields. These include employee name and address, employee number, check number, and check amount. The gross pay and all deductions are also listed. The year-to-date column shows the total pay and deductions from the start of the year or the employee’s first paycheck.