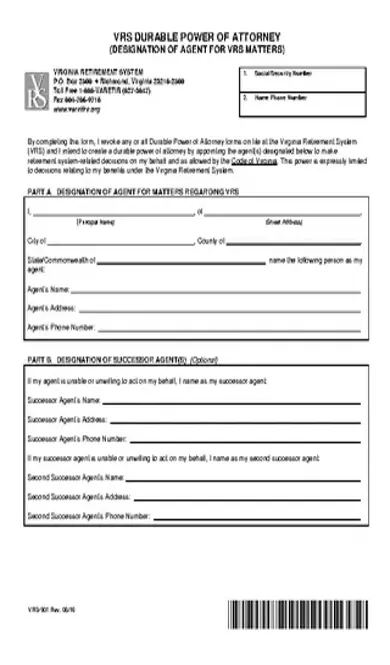

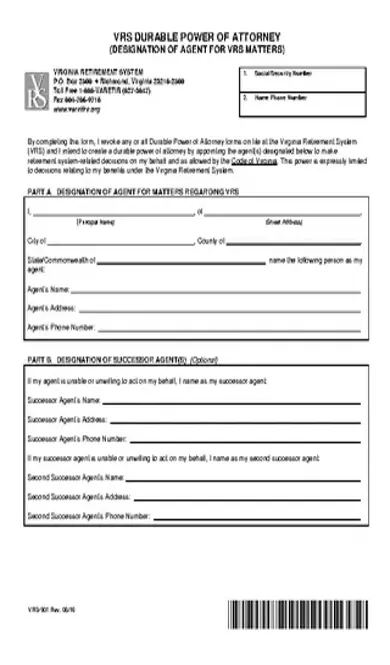

Durable Power of Attorney PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Durable Power of Attorney PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Durable Power of Attorney PDF with PDFSimpli.

[toc] Oftentimes, when a person becomes disabled or elderly, they have a hard time keeping up with official paperwork. Applications for benefits, mandatory tax forms, and other important documents all fall by the wayside. Rather than stress about remembering to file every required piece of paperwork, some people opt to use a Power of Attorney form.

A Power of Attorney form is an important legal document that allows for an individual to appoint one of their close relatives or friends to oversee financial and legal matters for them. The individual seeking the representation is called the Principal, while their representative is referred to as the Agent.

“Durable” is part of the form title because the responsibilities of the Agent will remain the same should the Principal become incapacitated in some way. For this reason, some elderly people will fill out the form even when they don’t have problems keeping up with paperwork. It helps to have someone already appointed to take care of their affairs if they become injured or too ill to handle documentation.

It’s important to note that this form is only meant to be used for financial and elgal purposes. Healthcare decisions must be delegated to a representative using a diferent form, the Medical Power of Attorney Form.

Durable forms are the most popular power of attorney form because they allow for the Agent to continue performing their duties even if the Principal becomes incapacitated and unable to see to their own affairs.

These forms concern two main parties: the Principal and the Agent. The Principal is the person whose legal and financial affairs will be handled. The Agent is the representative that they’ve picked to handle them. Once granted the power of attorney, the Agent will be able to make important legal and financial decisions and engage in financial transactions of multiple types.

In the majority of cases, the Principal is an elderly person who wants to make sure their assets will be cared for if they become incapacitated. They put the Agent in charge of their financial and legal affairs to reduce stress in their day-to-day lives and add a level of comfort and security.

The Agent should be a person that the Principal trusts. Not only should they be a close family member or friend, but they should also understand how to be responsible with money. They will need to handle the assets and finances of the Principal. It’s essential that the Principal pick someone capable of making sound financial decisions.

If any person wants to designate another trusted individual to handle their affairs if they become incapacitated, the power of attorney form is what you should use. For the right to make medical decisions on the Principal’s behalf, a different power of attorney form must be filled out. The Durable form only grants access to financial information and powers.

These are the financial powers designated to the Agent:

Ability to make deposits and withdrawals to the Principal’s bank accounts

Ability to lend and borrow money

Access to any existing safety deposit boxes, ability to create a safety deposit box, and ability to terminate any existing boxes

Information about government benefits including Social Security, health care, and other programs

Retirement plan benefits

Federal and state taxes, both involving tax returns and business tax filing

The ability to handle legal proceedings and file court forms on behalf of the Principal

The power to buy, sell, or lease property

The power to handle all personal assets

The ability to make gifts or otherwise give things away

The ability to handle insurance, including terminating policies, obtaining insurance, and updating policies, along with collecting any payouts

If the form has not been filed, and the Principal becomes incapacitated, there will be no one designated to make decisions in their stead. This can lead to potential chaos and financial hardship for the Principal. It’s also uncertain who would become the controller of the finances until such time as the Principal could take them over again.

This form allows the Principal to ensure that their financial information will be handled by someone they trust and care for.

The Principal and Agent should fill this out together.

The Principal will choose which financial powers they wish to give to the Agent should they become incapacitated. You’ll then need to choose whether the form is effective immediately, or if it only goes into effect should the Principal become disabled. This will be the Principal’s decision regarding whether they feel capable of continuing to take care of their finances.

You’ll need to look up the signature requirements in your state. For a power of attorney notice to be legally authorized, different states have different legislation. In some states, the form needs to be signed in front of a notary. Then, the notary must notarize that the signatures are legitimate and that the form has been witnessed.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/durable-power-of-attorney-form.pdf”]

When you authorize the form, you should make sure that you create at least 3 copies of the official document. One goes to the Principal, one to the Agent, and one to the Notary. If there are more than one Agents, each involved person should be given a copy of the form.

After the notary has officially authorized the form, it will be the Principal’s job to keep it. If they have a place they keep important documents, this is the best place for it. It’s important that more than one other person knows the location of the form, just in case the Principal becomes incapacitated.

With a Durable POA, the authorization benefits continue for the Agent even after the Principal suffers an injury or illness that incapacitates them. With a general POA, the power of attorney is suspended upon the principal’s incapacitation.