SSA561 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA561 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA561 PDF with PDFSimpli.

[toc] The Social Security Administration is responsible for making a great deal of decisions. They’re the ones who decide what benefits you receive for disability claims and retirement. They’ll also ask you to repay any accidental overpayment credited to you. If one of your requests has been denied, or you’ve been leveled with overpayment collections that you don’t believe are valid, there is a form you can use to appeal. The Form SSA-561 is an all-purpose form used in a multitude of different circumstances.

The form’s main purpose is to start an appeals process for any decision that the SSA made. When a person disagrees with the ruling that the SSA made, the Request for Reconsideration form is a way to ask the administration to reopen the case. It’s not guaranteed that an appeal will overturn a denial, but if you don’t appeal at all, you’re 100% guaranteed not to have your claim accepted.

This 4-page form covers a variety of issues:

You’re being asked to repay an overpayment, but do not believe you were overpaid

Your claim for retirement benefits was denied

Your claim for disability benefits was denied

Your request for medical or hospital compensation was denied

Any other decision in which the SSA denied a claim you made

The form can be used by anyone who wishes to start the appeals process for their claim or overpayment plan. If you want to use the form for overpayment, make sure that you believe the SSA did not overpay you. If you do believe that overpayment occurred, but you want to have the repayment waived, there’s a different form for that.

You can file a Request for Reconsideration with your local SSA office. This form is put out officially by the SSA.

If you’ve had a claim for benefits denied, especially a disability claim, you should file this form as soon as possible. You might also want to hire an attorney, especially if you didn’t have an attorney advising you as you filed your first case. Attorneys understand exactly what the SSA is looking for, and they’re able to make sure your application adequately reflects everything the administration is asking.

Any denied claim is worth an appeal. The worst that can happen is that the SSA decides to uphold the denial. If you don’t file an appeal, the SSA will uphold the denial anyway. At least an appeal gives you a chance.

If you don’t file the form, the SSA will abide by whatever their original decision was. You cannot start the appeals process in any other way. You’re not able to call to appeal on the phone, or fill out other documentation. This is the only form you’ll use.

Depending on the type of appeal you’re filing, you might also need to provide other documentation. Get in touch with your local SSA office to find out exactly what documentation is necessary.

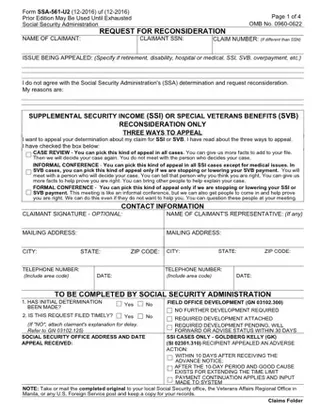

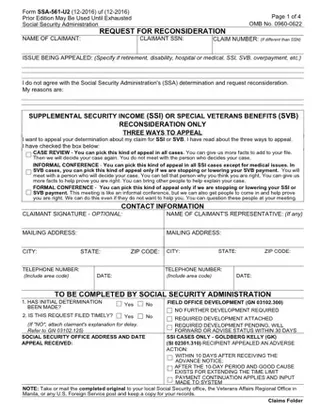

Write the name of the claimant, the claimant’s SSN, and the claim number if this is different from the SSN. Then, detail what issue is being appealed, including the type of denial it was. Below that is where you’ll write why you don’t agree with the decision that the SSA made.

If you’re looking for reconsideration about special veterans benefits or supplemental security income, you have three potential ways to appeal. In all cases, you’re able to pick the case review option. In all non-medical SSI cases, you can pick an informal conference. If the SSA is lowering or stopping your SVB or SSI payment, you can appeal with a formal conference. Check the box beside the appeal process you want to use.

You can optionally have the claimant sign the document. If a representative is filling out the form, like an attorney, they will need to write their name in the “Claimant’s Representative” section.

Provide the mailing address and contact information of all parties involved in the form, including both the claimant and the representative.

You don’t need to do anything with the part of the form labeled “For Social Security Administration Use Only.” Your local SSA office will be in charge of filling that out. [pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/form-ssa561.pdf”]

Yes. If you choose to have an attorney fill out the appeal form, they’ll be considered the claimant’s representative. They should provide their personal information in the “Representative” section at the bottom of the form. An attorney is generally considered a good idea because they may have concrete ideas about how to structure the appeal.

You can generally expect the process to take about 60 days, or 2 months. If you’re meant to be doing overpayment collections, these collections will pause until after a decision is made about your appeal.

You’ll indicate that you want to use a conference appeal on your Request for Reconsideration form. The SSA office will then get in touch with you about what this means.