Facts about the 1099s PDF template

[toc]

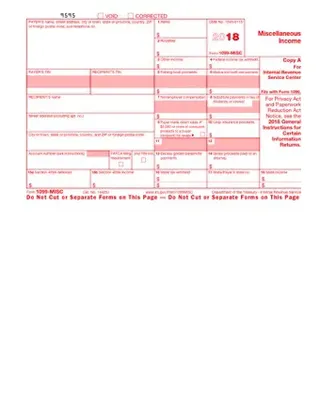

Filling Out IRS Form 1099-MISC PDF Form

This form is used by many American taxpayers every year. It is known as the IRS Form 1099-MISC. The form reports miscellaneous income to the Internal Revenue Service (IRS). Any type of income that is not included on a W2 needs to be reported. The 1099-MISC is typically issued by payers to independent contractors. If the form is not completed, there can be serious financial and legal consequences.

Why is the IRS Form 1099-MISC PDF used?

This is a very important tax form. TurboTax explains that the IRS “requires any person or company that makes certain types of payments to report them on a 1099-MISC to the recipient and the IRS.” The 1099-MISC form is filled out for a contractor that was paid over $600 during the year. This income can come in many forms. The most common types of income include services, prizes, gifts, and rent. If you accepted a substitute payment in lieu of dividends, you must fill out the form. Attorney payments are also included in this category. If you paid any gross proceeds to an attorney, you have to report it to the IRS. The 1099-MISC is an important form for keeping track of your income throughout the year.

Who Would Use the IRS Form 1099-MISC PDF?

The 1099-MISC form is used by many people. An independent contractor needs this form to report income. The payer also needs to complete the form for the IRS. A 1099-MISC shows that services were paid to the contractor by the payer. It is an essential form that can help fill out taxes at the end of the year. If you fail to complete a 1099-MISC form, there can be penalties from the IRS.

When Should You Use the IRS Form 1099-MISC?

The 1099-MISC is a critical form for independent contractors. It is imperative to show the amount of income that you have earned for the year. The information on the 1099-MISC helps the contractor to fill out the Schedule C attachment. Every payer needs to fill out a 1099-MISC form for their payees. If the work was under $600 for the year, the form is optional to send to a contractor. It is still a good idea to report the income. Even those who have not used services need to fill out the form. Any winnings from a game or drawing need to be reported. If you play at a casino and have won over $600, you should have received this form. Rent and royalties need to be reported. The 1099-MISC must be sent to a payee by January 31st. The IRS should receive their copy by the end of February.

What are the Consequences for not Using the IRS Form 1099-MISC?

The IRS has severe penalties for those who do not fill out a 1099-MISC form. According to Zacks, “The later you file a 1099-MISC, the higher the penalty from the IRS.” If you fail to file in 30 days, the penalty is $30 per form. Payers who fail to file by August 31st will see the penalty increase to $60 per form. By filing a 1099-MISC form, you can stay out of legal trouble. It also helps keep your relationship between contractors in “good faith” as well. Contractors will not work with someone who cannot file the proper tax paperwork in time. An unfiled 1099-MISC form can cause a contractor many problems when they have to file their own taxes. It is the responsibility of every payer to fill out and file the form on time. The 1099-MISC form needs to be sent to the payee by January 31st.

Steps for Filling Out the Free 1099 Form PDF Form

- This form can be download directly from the IRS website.

- You will need to fill out your Federal Tax ID number. This is usually your Employer Identification Number (EIN) or Social Security Number (SSN).

- The contractor’s SSN or EIN will need to be added to the correct box.

- There is a box listed as “Non-employee compensation.” You have to enter the amount of money that was paid to the contractor. This is typically found on the form at Box 7.

- Any federal or state taxes that have been withheld must be entered. Boxes 4 and 11 are the places to list that information.

- You can complete the form by filling out all your personal contact information.

- The form is complete and can be delivered to the contractor.