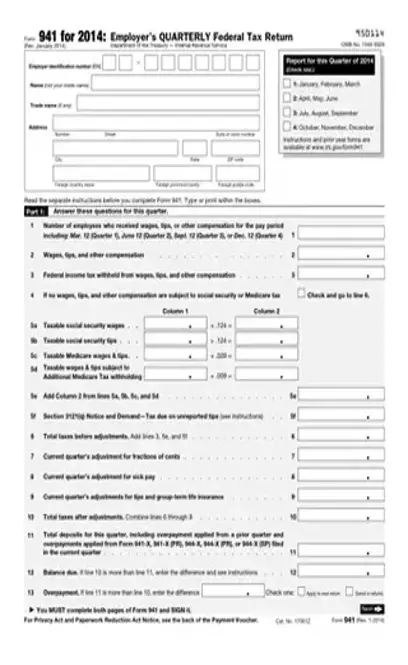

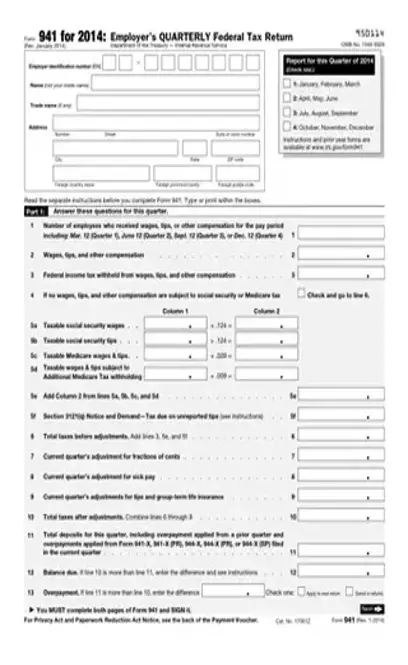

IRS 941 For 2014 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 941 For 2014 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant IRS 941 For 2014 PDF with PDFSimpli.

Business must complete Form 941 for the IRS for each quarter of fiscal year. It refers to information on payments of employment taxes, business type and reports it for the current and prior quarter.

IRS Form 941 lets a business report its employment taxes paid. Employers can choose to file the 941 form rather than the Form 944, but must request this change.

The for 2014 refers to the year of use of the form. The IRS updates its forms annually. You may not use the current form since that applies to 2018.

If a business already filed a form 941 for 2014, do not file another one to update information. Instead, use form 941-X. It is the appropriate form for amending information.

Any organization with employees should use this form. Specifically, the following organization types use the form:

sole proprietorship;

corporation or limited liability company (LLC);

a partnership which includes a LLC treated as a partnership;

an unincorporated organization;

a single-member LLC treated as a disregarded entity by the IRS;

a trust or estate.

Businesses, estates and trust must complete this form quarterly as a part of their annual return. They should file it with annual tax form for the business and during the other three quarters of the fiscal year.

The organization can receive steep penalties for not filing its taxes or filing inappropriately. Whether accidental or on purpose, not filing the proper tax forms and making payments results in monetary and legal penalties.

The first set of questions on form 941 pertains to the current quarter. The IRS refers to it as Part One.

Enter the number of employees who received wages, tips or other compensation.

Enter the total amount of wages, tips and other compensation.

Enter the federal income tax withheld from wages, tips and other compensation. Complete line four only if no wages, tips and other compensation paid are subject to Social Security or Medicare tax.

Lines 5a to 5e refer to specific information on taxable Social Security and Medicare wages and tips. On line 5a, enter the taxable Social Security wages.

On line 5b, enter the taxable Social Security tips.

On line 5c, taxable Medicare wages & tips.

On line 5d, taxable wages & tips subject to additional Medicare tax withholding.

On line 5e, total Social Security and Medicare taxes.

On line 5f, you’ll find the section 3121(q) notice and demand tax due on unreported tips.

On line 6, enter the total taxes before adjustments.

On lines seven through nine enter the tax adjustments for the current quarter. On line 7, enter the current quarter’s adjustment for fractions of cents.

On line 8, enter the current quarter’s adjustment for sick pay.

On line 9, enter the current quarter’s adjustments for tips and group-term life insurance.

The next few lines refer to the prior quarter’s adjustments.

On line 10, enter the prior quarter’s total taxes after adjustments.

On line 11, enter the qualified small business payroll tax credit for increasing research activities.

On line 12, enter the total taxes after adjustments and credits.

On line 13, enter the total deposits for the prior quarter.

On line 14, enter the balance due. It also contains a note on what to do if the business can’t afford to pay in full.

Line 15 addresses overpayment.

In Part Two, the IRS asks that the business explain its deposit schedule and tax liability for the current quarter.

Enter the total tax liability for the current quarter on line 16. In a note, it explains how to adjust tax liability using the qualified small business payroll tax credit for increasing research activities. The research activities information refers to the amount reported on line 11 in Part One.

In Part Three, the IRS requests a business description and specific information.

On line 17, let the IRS know if your business closed. If you’re a seasonal employer, mark it on line 18.

The one-line Part Four, requests permission to speak with the business’ third-party designee.

Part Five provides the signature area. It specifies the approved roles that can sign. These include: sole proprietorship; corporation or limited liability company (LLC); a partnership which includes a LLC treated as a partnership; an unincorporated organization; a single-member LLC treated as a disregarded entity by the IRS; a trust or estate; and the alternative signature method. There is a blank for paid preparer use.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/irs-form-941-for-2014.pdf”]

Make federal tax deposits using electronic funds transfer (EFT).

Yes, all tax forms can now be filed electronically with the IRS.

Yes, you do. Your CPA or financial manager can tell you this.