profits and losses sheet Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant profits and losses sheet with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant profits and losses sheet with PDFSimpli.

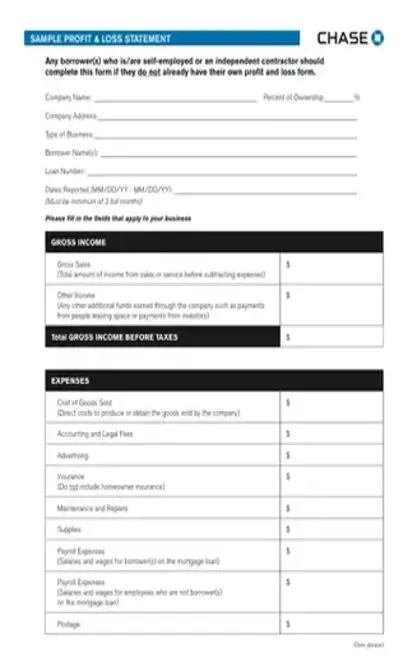

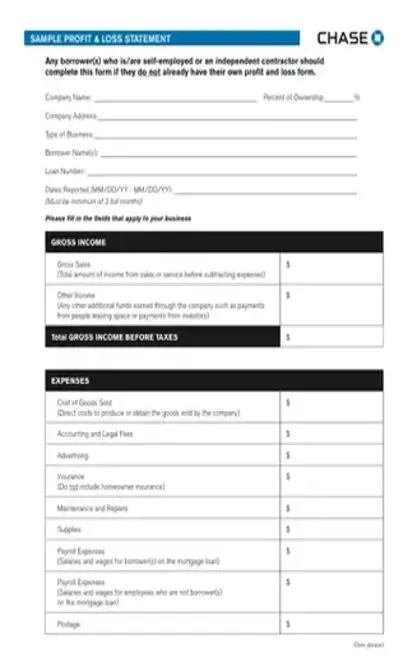

Being able to see at a glance whether companies are profitable or not, and why, is vital for business owners, partners, banks and investors. Companies record valuable information about gross income and expenses using a profits and losses sheet, also known as a P&L form or an income statement.

Put simply, it shows whether a company made money or incurred debt during a certain month, year or quarter. This statement considers gross income from sales, interest and the total amount of expenses including the cost of products, operating expenses, employee salaries and taxes paid during this time period. Income sources are often listed individually, helping organizations determine what sales avenues or subsidiaries are the most productive. With separate entries for things like the cost of goods, raw materials expenses, marketing costs, salaries and other operating expenses, owners can see exactly where money is going and how to stimulate greater profit margins. Sole proprietors and partnerships also find the information effective for streamlining operations, cutting unnecessary costs and avoiding overspending.

The value of keeping good records regarding income sources and expenses makes profits and losses sheets valuable for all companies, no matter how large or small they are. Here are some important benefits: Key data for increasing profitability Trustworthy accounting of profits and costs for shareholders and investors Ability to make smart business decisions based on real financial standing Small businesses benefit from knowing exactly how much profit they can reinvest into expansion or needed technologies. If owners need to make changes in spending to stay profitable, income statements show exactly where those changes should happen. For example, are personnel costs excessive? Would it be best to contact a different raw materials supplier? This knowledge gives you close control over every aspect of your company. Corporations use income statements extensively to report back to their shareholders and investors. Proof of solid profits drives investor confidence and leads to stronger stock prices.

Many businesses create profits and losses sheets on a quarterly or annual basis; some organizations prefer monthly reports instead. To determine how often you should create them for your business, it’s helpful to analyze several factors: How often do I pay taxes? The IRS requires businesses to keep accurate records of profit and loss information to assess taxes properly. If you pay taxes on a quarterly basis, you need to have, at minimum, quarterly profit and loss statements to match. Do I have creditors or investors? Lenders tend to be cautious, so they may request or require monthly profit and loss statements to keep an eye on your company’s financial health. How big is my company? When multiple divisions, subsidiaries or chain locations are involved, frequent P&L statements are essential for productive meetings. What is my role? If you’re a sole proprietor or an independent contractor, you may have a pretty good idea of your general cash flow. Annual income statements may be sufficient. How long have I been in business? Newly-created companies in contrast to businesses that have shown profitability for a long time are scrutinized more closely. When launching a startup, stick to monthly P&L sheets.

The IRS requires careful records regarding your company’s net profit earned and total expenses. Sole proprietors record this information using Schedule C on their 1040 tax form. So while profit and loss statements themselves aren’t submitted to the IRS, the information contained within them is. Incorrectly reporting net income or claiming fraudulent expenses can result in significant penalties. At the very least, having access to frequent P&L statements makes filling out your personal and business taxes far easier. In addition, without the financial data from income statements to back you up, securing loans from banks or potential investors is practically impossible. Even stock prices depend on accurate reporting. P&Ls that contain errors or omissions can send stock prices and investor confidence plummeting.

Choose a form: For simple totals, opt for an easy layout with gross profit, gross expenses and net income. For deeper analysis, get comprehensive with individual entries for profit and expense sources.

List gross income: Write down all income, from both primary sales related to your main focus and secondary sources. In tuna manufacturing, tuna sales are primary income, and renting out freezer storage would be secondary.

List cost of goods: This is the amount spent to purchase or manufacture the products you sell, including raw materials, factory overhead, storage costs and related wages.

Write down sales costs: These are wages paid to sales staff, marketing and advertising costs, and shipping.

Itemize operating expenses: Operating expenses are administrative salaries, utility bills, maintenance and anything else required to run the company. 6. Include outstanding expenses: Office equipment or tech systems are outstanding expenses, but only the portion of corresponding deprecated value. A $500,000 piece of equipment estimated to last 10 years would be counted as $50,000 annually. 7. Calculate your total net income: Take your gross profit and subtract the expenses from steps 3-

The result is your net income, or total profits after expenses.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/profits-and-losses-sheet.pdf”]

Resources: https://smallbusiness.chron.com/profit-loss-statement-tutorial-4009.html https://fitsmallbusiness.com/profit-and-loss-statement-pl-income/ https://www.accountingcoach.com/blog/purchase-of-equipment-profit-and-loss-statement

This means you spent more money than you made, giving you a deficit instead of a gain. This doesn’t mean your business is doomed. With the information you learn from the P&L statement, make needed changes to guarantee better profits next quarter.

Assets such as existing inventory aren’t mentioned directly in profit and loss forms, unless they were purchased, manufactured or damaged and lost during the quarter under review. Assets are mentioned in a separate financial report known as the assets and liabilities statement.

The answer depends on whether you’re a small business using a cash accounting method or an accrual accounting method. In the accrual method, profits are recorded once invoiced, and so are expenses, regardless of when money is actually received. Banks, investors and the IRS typically require accrual accounting.