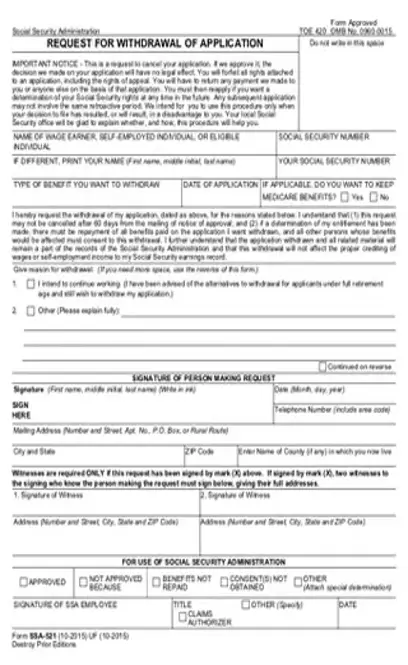

If you’ve weighed the pros and cons of a withdrawal, and decided you still want to go through with your retirement application withdrawal, you can complete the form in the following steps:

Write the name of the eligible individual along with their Social Security number

Write the name of the eligible individual along with their Social Security number

If you, as the person filing the application, are a different individual, print your name and give your Social Security number

If you, as the person filing the application, are a different individual, print your name and give your Social Security number

Note the kind of benefit you wish to withdraw, the date the application was filed, and whether or not you wish to keep your Medicare benefits

Note the kind of benefit you wish to withdraw, the date the application was filed, and whether or not you wish to keep your Medicare benefits

Explain the reason for the withdrawal. If you intend to continue working, check Box 1. For any other reason, check Box 2 and give a full explanation.

Explain the reason for the withdrawal. If you intend to continue working, check Box 1. For any other reason, check Box 2 and give a full explanation.

Sign the form, provide the date, and give the telephone number you can be reached at

Sign the form, provide the date, and give the telephone number you can be reached at

Provide your mailing address including the county name in which you are a resident

Provide your mailing address including the county name in which you are a resident

If witnesses are required, have two witnesses who saw the signing also provide their signatures and full mailing addresses

The rest of the form is to be filled out by the Social Security Administration.