SSA-632 Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA-632 with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant SSA-632 with PDFSimpli.

[toc] Everyone makes mistakes, whether that entity is an individual, organization, or business. The Social Security Administration sometimes makes errors. Overpayments occur when the administration gives you more money than you were entitled to in your benefits. When this happens, you’ll receive a notification. There are a number of forms associated with how overpayments are handled. SSA-632 is one of them.

If you’ve been given a notice explaining the amount you’ve been overpaid, along with ways you can pay the administration back, you have a few options. If you don’t believe you’ve received extra payment, you can fill out an application to have the request reconsidered. This appeal process is Form SSA-561.

However, if you do agree that you’ve been overpaid, and you’re willing to repay the money, you don’t need to fill out one of these forms. That said, some people find that they’re not able to pay the money back in the same time frame listed by the SSA. When this is the case, they’ll need to fill out a Form SSA 632, also known as a Request for Change in Repayment Rate or Waiver of Overpayment Recovery.

If you do agree that you’ve been overpaid, but you do not believe you should have to pay the money back because you can’t afford to, you should file the same form. Until a decision is made, the SSA will cease to recover your overpayment.

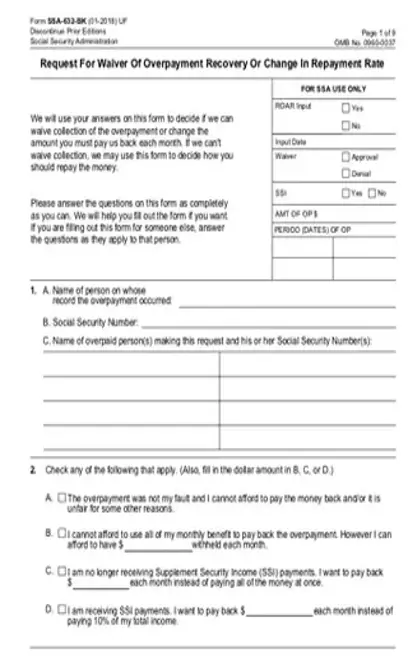

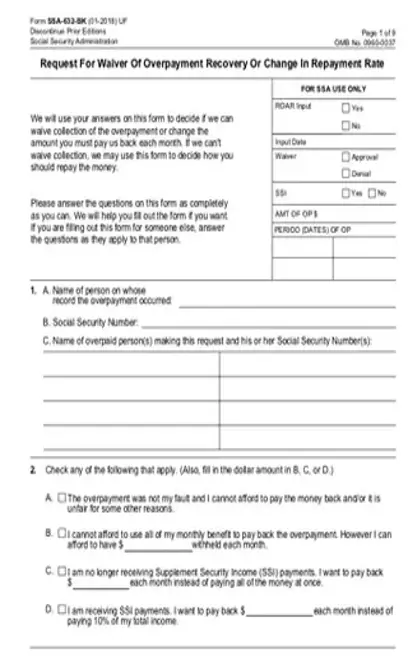

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/ssa-632.pdf?sv=2018-03-28&si=readpolicy&sr=c&sig=MXHnWmn0sXNXztiU%2Bugk2d7DV7KBCOuXF3oBMx0EeEw%3D”] The form is meant to be used by anyone who has received a notice of overpayment from the SSA. This notice will explain the exact amount that you were overpaid, along with a payment plan to repay the debt. If you agree that overpayment happened, there are two circumstances in which you’d want to file an SSA 632 form:

You cannot afford to adhere to the original repayment plan, so you need to apply to have a new repayment plan put in place

The overpayment was not your fault, and you cannot afford to make a repayment, so you want to request that the overpayment be waived entirely

This form should be used if you meet any of the circumstances described above. It’s very important that you file the form as soon as possible, because your overpayment collection will not cease until the form is filed. After the form is sent to your local SSA and filed, your overpayment collection will pause until the SSA reaches a decision.

If you fail to complete this form, your other option is to file a request for reconsideration. Doing so will start an appeals process in which the SSA will need to look over your case again. However, this method should only be used if you believe that you have not been overpaid.

If you do agree that overpayment occurred, but you fail to file a request for a waiver or new repayment plan, your overpayment collection will continue to happen in the manner described by the original notice. You will pay back the debt until you’re entirely paid up, and then your benefits will continue as they usually do. This option is fine for people who have the money to repay the debt, but it can be detrimental if you cannot afford the payments the SSA demands.

If you’re the person to whom the overpayment occurred, write your name in 1A. If another person was subject to the overpayment, write their name instead. Record the Social Security number of the associated person.

If multiple overpaid people are making the request at once, write all of their names along with their Social Security numbers.

Check the reason for submitting the form. You’re given four main options.

If you are a representative acting for a beneficiary, take down information about the beneficiary in Question 3. If you’re being asked to repay the overpayment for someone else, fill out question

Question 5 requires an explanation for why you believed you were receiving the overpaid money, along with a reason you weren’t at fault for the overpayment. Question 6 asks for further information about the change that caused the overpayment. If you’ve ever experienced previous overpayments, you’ll note them on Question 7.

In Section II, you’ll answer questions about your financial status. This includes whether you currently possess any amount of the overpayment, any property or cash you gave away after you received the overpayment notice, and any property you sold after you received the overpayment notice.

List the members of your household, your assets, and your monthly household income. Then note your monthly household expenses. Compare your total monthly income with your total monthly expenses.

If you have more expenses than income, provide an explanation for how you pay your bills.

Explain the availability of funds you have and note whether you expect a change in your financial situation within 6 months.

If you need to continue any questions on more lines, use the Remarks space at the bottom of the form to do so. Then provide your signature, contact information, and mailing address.

When a person files for bankruptcy, any overpayments are considered to be unsecured debts like medical bills and credit card debt. This means that you can discharge your SSA obligation if you file for bankruptcy.

You’re eligible for Social Security benefits if you have less than $2,000 in the bank. The administration also counts cash and savings toward this threshold.

You can generally expect to wait a few weeks for your request to be processed and approved or denied. However, from the moment you file the request, your overpayment collections will cease until a decision is made. This means you don’t have to worry about payments you can’t afford while you wait for a decision.