UCC3 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant UCC3 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant UCC3 PDF with PDFSimpli.

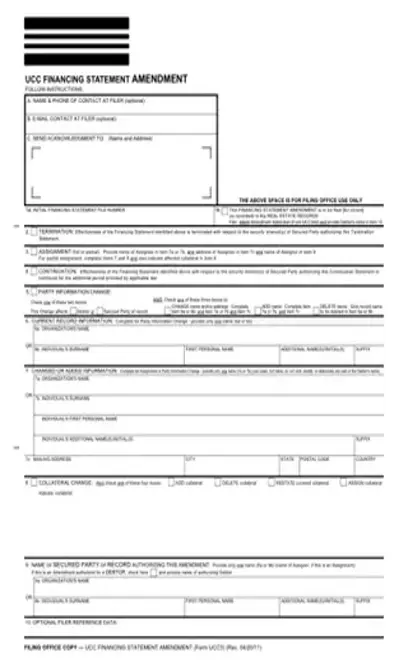

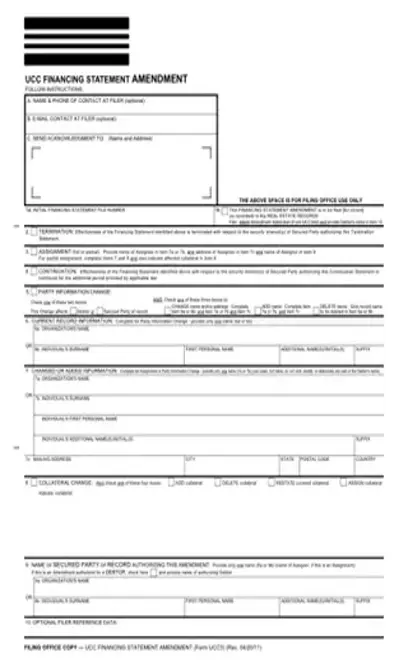

[toc] A UCC-1 form is filled out when a creditor needs to give notice of possible interest in a debtor’s personal property. However, this isn’t the only related form. If you need to make amendments to a UCC-1 form, you’ll use a UCC-3 form. Both of these forms have specific circumstances in which they must be filed.

A UCC-3 form is used to amend a UCC-1 form. To understand that, you’ll first need to understand the UCC-1 form. If you want to file a UCC-1 form, you’ll need to give a great deal of information about you, as the creditor, along with information about the debtor. The exact information required varies depending on whether you’re filing against an individual person or a business.

If any amendments need to be made to the form, you’ll use the UCC-3 form to do so. This requires the following information:

An acknowledgement address and name

The file number that corresponds to the original UCC-1 form

Current record information regarding the debtor written on the initial UCC-1 form

Name of whatever party was the secured party when the initial UCC-1 form was filed

Reasoning for amending your UCC-1 form

If a creditor has already filed a UCC-1 form, but they need to make an update to the form, they’ll need to file a UCC-3 form. They will need to include the appropriate filing fee. For your UCC-1, the filing fee is $6.00 for one or two pages and $12.00 for three or more pages. The same pay rates are true for the UCC-3.

[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/ucc3-form.pdf”]This form is necessary whenever a creditor wishes to make changes to a UCC-1 Financing Statement. It can cover the following types of amendments:

Termination of the first statement

Continuation of the first statement beyond the specified dates

Assignment of the debt

Amendments to collateral information, the secured party, and personal information about the debtor

UCC stands for Uniform Commercial Code. The United States gives state governments the right to enact state-specific laws. There are, however, a number of legal problems that tend to transcend state lines. Because of how uniform these problems are, a uniform way of dealing with them is ideal. The UCC is a collaboratively-written law meant to streamline commercial transactions and make sales easier.

When a UCC filing is made for a small business, the lender will generally have a lien on the business’ inventory and equipment. The small business is given a loan in exchange. UCC filings have the greatest impact on small businesses. It’s the job of the creditor to make sure the statement, and any follow-up amendments, are all filed with the secretary of state wherever they live.

The consequences for not filing the form will vary depending on the reason it needs to be filed. For example, if a lender needs to file for termination after a debt is paid off, they should use the UCC-3 form. If they don’t, the debtor may continue to have a lien on their property even after it’s paid off. Liens automatically last for five years.

If the lender intends for the loan to continue being in place past the previously-established date, they should use the UCC-3 form. Otherwise, their agreement will end at the originally-specified point. The creditor must also use the UCC-3 form if they made any mistakes on their original form, or if information about the debtor has changed. Failing to provide this might result in an application being rejected.

You can optionally give the name and phone number of a contact at the filer’s office. You can also provide a name and address that the government will send an acknowledgement to.

In Line 1, provide the original financing statement file number. Then, check the box that indicates the reason you’re filing the amendment. In Box 6, you’ll provide the information currently on the record. This includes the name of the organization that the loan is made out to, or the full name of the individual the loan is made out to.

Box 7 will handle your changed information. Print the new information. If the organization’s name or individual’s name remains unchanged, just print the same information you gave in Box 6. Provide a mailing address, the type of organization, and the jurisdiction of the organization. If there is any organizational ID number, this will be provided in Box 7g.

If you’ve amended the collateral you’re using, you should check one box that fits the collateral’s definition. The box below is where you’ll put your collateral description. Make sure you describe it in full.

Box 9 is where you’ll take down your company’s name or your own name. Box 10 is optional and provides filer reference data.

If you have your filing rejected, generally it will be accompanied by a letter instructing you on how to make corrections.

Most commonly, a filing will be rejected for one of the following reasons: The secured party and debtor appear to be the same person The form fails to provide all required information The form fails to provide an accurate file number The form does not include the filing fee If you have your filing rejected, generally it will be accompanied by a letter instructing you on how to make corrections.

If a UCC-3 is filed with the reason being “termination,” it’s only an amendment to the original financing statement. The status of a lien can only be changed after the lapse date.

If you file one or two pages, you only need to pay $6.00. If there are more than two pages, you’ll pay $12.00.