uniform residential loapplication PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant uniform residential loapplication PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant uniform residential loapplication PDF with PDFSimpli.

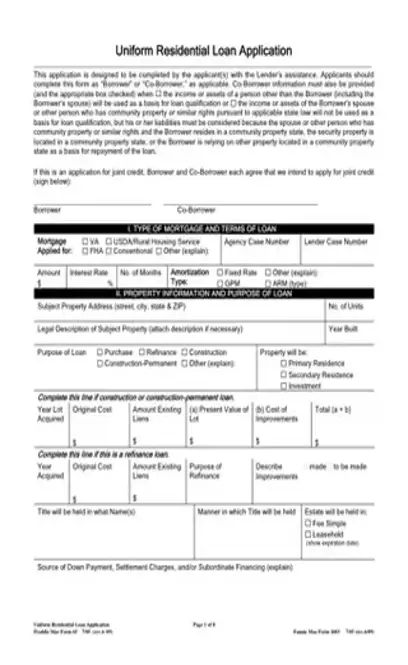

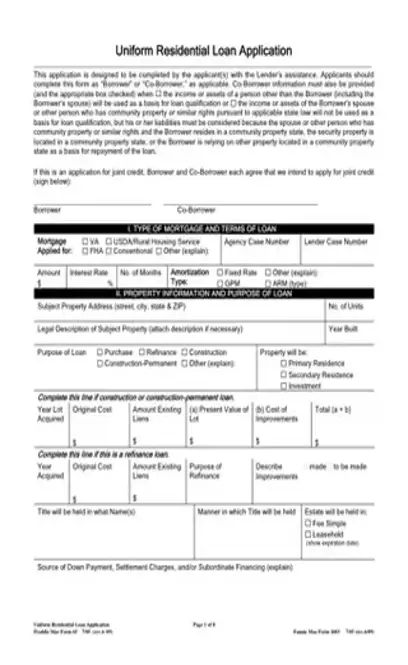

[toc] Loan applications are available for all types of purchases, but the residential loan form has several special conditions. Because the purchase is for real property and the extension of credit is usually for years, the process is in depth. There are many supporting documents that are provided along with the completed form, but the application goes over the process systematically.

The application is used so home loan lenders can gather credit, debt, and income information from a potential borrower. Credit information not only comes from credit cards, but additional mortgages, student loans, car loans, and personal loan. Debt can be calculated from the credit. Income is verified with paycheck stubs, W2s or 1099s, and tax return.

This information helps lenders decide how much money the institution should loan the borrower. The information provided also allows the lender to determine the credit-worthiness or credit history of the borrower. The lender maybe looking for any late payments or overly extended credit, and paid in full accounts.

The form is organized so that someone filling it out can follow the requests. It makes gathering the figures and paperwork a simpler process by breaking it down into small steps.

The application is used to select the choices of mortgages that the borrower can qualify for. Some of the choices are the VA or veteran’s loan and the FHA mortgage backed by the US Federal Housing Authority. It also has a selection of amortizations. Bank Rate offers a free amortization table.

There are several individuals, businesses, and couples that will need to use the application. The individuals will be people apply for a mortgage. They can apply as one single person or partners.

Mortgage lenders and banks are the main types of businesses that the form applies to. Private parties that are loan money to someone to purchase a home can also use the form to decide whether are not the person has enough good credit and income to make the payments.

Partners can be related or have no relation. It does not matter. One will be the borrower, and the other is the co-borrower. Both parties assets and credit will be used on the application, and the lender will take into consideration their total debt and income.

The PDF application should be used when a person wants to apply for a loan to purchase a home. The form can be used when the potential buyer is looking into getting a government supported programs, such as the VA or FHA. The process can be used to apply for traditional or conventional financing. Lending Tree refers to conventional financing as a home loan not backed by the US federal government.

You should use the paperwork to gather personal information about a borrower. Information that needs to be provided in most cases are the social security numbers, birthdays, and marital status. Borrowers will be asked to declare assets, such as stocks, bonds, or other savings accounts, and what financial institution is holding the savings papers. All the holdings should be disclosed. Places that assets can be held in are:

Banks

Credit unions

Off shore accounts

Stock brokerage accounts

Other assets the form will address are other land or real estate holdings, automobiles, and retirement funds. It is a detailed process, but using the form simplifies the itemization.

Not using the application could lead to certain very pertinent information not being disclosed by the buyer. If certain areas of debt are left out of the loan process, the borrower’s true loan limit is not revealed. Some of the areas that could be missed if the uniform application is not used are:

Child care

Union dues

Business expenses

Home office expenses

Home owner association dues

Without all of the figures that makeup an individual’s person finances the home loan lender will not be able to make an accurate loan. Worst-case scenario is the lender lends the borrower too much money. The borrower cannot keep up with the payments, and then the lender is forced to foreclose on the borrower. Once foreclosed on, the borrower’s credit is damaged and the ability to purchase a new home is extremely limited for many years.

Filling out the loan application may take some time. There are several fields to fill out and you may need to get the information together in order to complete the application. Steps to complete the application are:

Provide your personal contact information

If you have already indentified it, give the address of the real estate you are looking to purchase

Supply your employers name and contact details

Declare your households income and assets

Declare your households debt and credit

The form will also ask all borrowers about their citizenship and if they plan on living in the house. The lenders want to know if you are going to be using the property as income property, such as a rental house, a second home or vacation property. This will further determine the loan structure. Quicken Loan states your main home is considered your primary residence, a second home is not rented, and investment property or rental homes produce income.

The application asks for the borrower’s gross monthly income. The gross income is the amount made before taxes and other expenses are taken out. You net income is the amount of gross income minus the expenses.

An S&L stands for savings and loan institutions. This type of banking was popular in the 1980s, but most of the institutions were deregulated. The category that has taken its place are banks and credit unions.

The form states self-employed borrowers will need to provide tax documents, financial statements, and possibly other papers. The lenders might want to see a business profit and loss statement. The borrower can create their own, or an accountant may be able to help you prepare the statement. Here is an profit and loss check sheet courtesy of Small Business.