VA 21-601 PDF Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA 21-601 PDF with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant VA 21-601 PDF with PDFSimpli.

[toc] It’s a sad fact of life that veterans sometimes die. When a veteran passes away, their family will commonly be left thinking, “What do we do now?” There’s too much to think about and organize, and you have to worry about the mounting costs of funeral expenses as well. However, there are a few different benefits that you may be eligible for through the VA. One of these benefits is access to the accrued amounts due to a beneficiary who is deceased.

Veterans are eligible to receive a number of different benefits through the Department of Veterans Affairs, otherwise called the VA. These benefits extend to their dependents, including their spouse and dependent children. In some circumstances, a veteran will die without collecting all of the benefits they were entitled to.

When a veteran passes away, and they had not yet been paid their accrued benefits at the time of death, that’s when this type of form comes into play. When filed, the form allows a spouse or other dependent to apply for the accrued benefits that belonged to the deceased veteran.

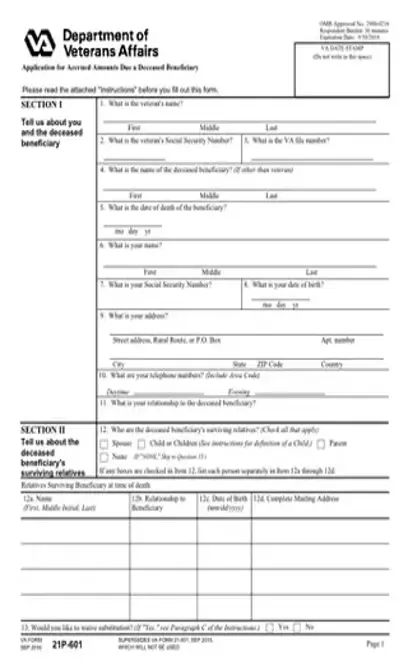

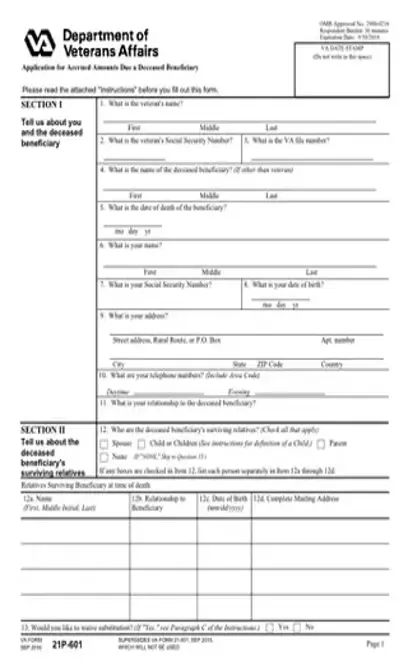

The Form 21-601 is designed exclusively for use by people who need to claim accrued benefits that had not yet been paid to the beneficiary when they died. For every person who claims a share of these accrued benefits, a separate copy of the form must be completely filled out and filed.

If you’re the dependent parent, spouse, or dependent child of a deceased veteran, you can apply for death benefits through the use of VA Form 21-534. This form will entitle you to any accrued benefits, and if you meet the correct circumstances, will also entitle you to payments as compensation for your loss.

If a veteran dies without being paid their accrued benefits, the benefits will be transferred to their dependents following a law-established line of succession. These are the rules for the sharing of benefits:

For circumstances where the deceased is a veteran:

Accrued sums could be paid in full to a surviving spouse, or

Accrued sums could be given in equal shares to each of the veteran’s children

If there’s no spouse or children, shares might be given equally to the veteran’s parents, provided the parents were dependent upon the veteran when the veteran died

If none of these circumstances are met, the full amount might be given to the other surviving parent, provided they were dependent upon the veteran’s income when the veteran died

For circumstances where the deceased is a veteran’s surviving spouse:

Accrued benefits will be shared equally between each of the veteran’s children

When the deceased is a child:

Accrued benefits are divided equally between children of the veteran who meet eligibility requirements for death compensation, indemnity and dependency compensation, or a death pension

Under the law, a “child” refers to an unmarried child who is under the age of 18. If they’re going to college, they can be over 18 years old, but they must be less than 23. If any children are permanently disabled or otherwise unable to support themselves, they can count as a dependent regardless of their age.

With all of this said, if there are lump sum benefits accrued, all children will be considered recipients regardless of whether they’re dependents or not. This means that adult children and married children are also entitled to shares.

The form should be used if the following circumstances are met:

A deceased beneficiary had accrued benefits that had not yet been paid to them at the time of their death

The surviving spouse or dependents wish to claim these accrued benefits

The surviving spouse or dependents don’t meet the circumstances for a death pension or other death benefits

If you do meet the circumstances for additional death benefits, you should be using Form 21-534 instead of this one.

If a surviving dependent fails to file this form, and they also don’t file a Form 21-534, they will not receive any of the accrued benefits. Claimants are entitled to a share of the accrued benefits if they meet the correct circumstances and line of succession.

Use Section I to provide information about the deceased beneficiary in question. You’ll need to give the name of the veteran, their VA file number, and their SSN. You’ll also need to give the name of the deceased, especially if this is different from the veteran. After you’ve filled out the correct names and dates, write your own name, address, telephone numbers, and the relationship you had to the deceased.

Section III is where you’ll write about any expenses and debts incurred due to the burial and last sickness of the deceased. You’ll need to record the nature of the expense, the amounts paid, and information about whether you’ve been reimbursed.

Section IV will be filled out by your unpaid creditors. It’s a waiver of your reimbursement.

Section V is the section you’ll use to sign the statement, along with the date you sign. The additional page has Section VI, which is optimized for remarks. You’ll only use the remarks space if you have any additional notes, or if you didn’t have room for required information on the previous pages.[pdf-embedder url=”https://cdn-prod-pdfsimpli-wpcontent.azureedge.net/pdfseoforms/pdf-20180219t134432z-001/pdf/va-form-21-601.pdf”]

After the deceased’s day of death, you have one year to file your claim for their accrued benefits.

The line of succession is clearly denoted to avoid any confusion.