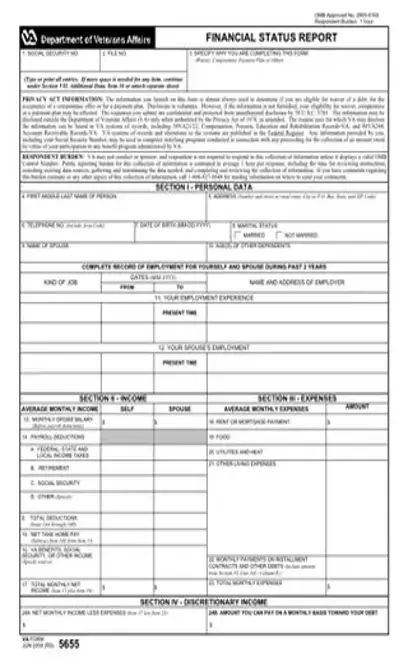

There are a number of reasons a person might fill out a Financial Status Report. For the most part, this form is used if a person is meant to repay the VA, but they do not have the financial capacity to do so. The form captures a zoomed-out look at their overall finances. This record is kept by the VA to determine how to proceed with the repayment. Because the report often coincides with benefits claims, repayment problems, and collections, this might not be the only report you need to file. However, it is one of the most important. This is the report the VA will use to at-a-glance approve your application for a repayment adjustment. These are the most common types of repayment adjustments:

Waivers of overpayment or other owed fees, in which the claimant no longer needs to repay the debt

Waivers of overpayment or other owed fees, in which the claimant no longer needs to repay the debt

Compromises, in which the claimant negotiates with the VA to arrive at a sum they’re more easily able to pay

Compromises, in which the claimant negotiates with the VA to arrive at a sum they’re more easily able to pay

Payment plans, in which the claimant will adjust the schedule by which they’ll repay the full amount owed to the VA

PDFSimpli is the best solution for filling out documents, editing & annotating PDFs and converting document filetypes. Don't delay, start today.