Facts about the w 2 form 2016 template

[toc]

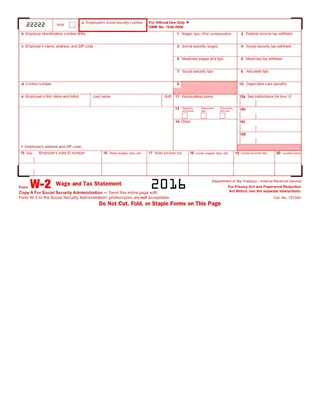

Filling Out the W-2 Form 2016

If you employed at least one person in the year 2016, you are required to fill out the W-2 form 2016 for any employee who earned $600 or more. If you provided compensation in cash equivalents, such as taxable benefits instead of dollars, you must still file the form. Regardless of the amount the employee earned, you must issue this form for all employees who had taxes withheld.

What Is the W-2 Form 2016 Used For?

The W-2 Form 2016 provides employees with a way to prove how much they earned as well as how much they paid in taxes to the federal, state, city and local governments. It also shows taxes paid to Social Security, Medicare and other government programs. As an employer, this form provides you with a way to prove how much you paid each employee and that you are compliant with the law in withholding the correct amount of taxes. Employers are required to include any taxable prizes, tips, commissions or other means of compensation on the form. Because the IRS mandates income and tax reporting on all employees, employers are required to file a W-2 form even if the employee is a relative or friend. The IRS uses W-2 forms to verify incomes and ensure individuals are paying the appropriate amount of taxes. Employees use this form to verify the taxes paid over the course of the year and get back any amount that was overpaid. Because employees can generally choose how much is withheld for taxes from each paycheck, and each employee is eligible for different tax write-offs, some employees get money back while others owe money.

Who Would Use the W-2 Form 2016?

Anyone who earned over $600 from the same employer in money or cash equivalents would use the W-2 form when filing taxes. All those with any amount of earnings who had taxes withheld would also need to use this form to verify the amount of taxes already paid. You should have received a W-2 form from your employer for the year 2016 if you: Earned at least $600 over the course of the year Earned less than $600, but still had taxes such as Social Security and Medicare withheld Received payment only in the form of tips or prizes that were taxable Never got a paycheck but received insurance benefits, free rent or another type of non-cash payment totaling at least $600 per year Every employer who pays an employee more than $600 annually, including non-cash compensation, must submit a W-2 form for each employee to the IRS and to the employee to report wages and taxable income.

When Should You Use the W-2 Form 2016?

You may have forgotten to file a W-2 form for an employee for a recent tax year, or submitted one with incorrect information that needs to be re-submitted. In these and any other circumstances where you as an employer didn’t file a W-2 or the correct W-2 for an employee, you must file one as soon as you can. You need to be compliant with federal law and ensure all employees have the correct information to file their tax returns. As an employee, if you never received a W-2 form, it isn’t too late to request one from your employer. You are still responsible for filing a tax return each year, even if your employer doesn’t provide you with a W-2. Both employer and employee who missed the deadline to submit a W-2 form for any given tax year should still send them in, even though they will be considered delinquent.

What Are the Consequences for Not Using the W-2 Form 2016?

The IRS doesn’t ignore missed tax returns or employers who fail to submit W-2 forms for their employees. Sometimes the IRS will make notes of your missing forms on your record without sending you a notice, so you shouldn’t assume they are unaware of your delinquency. If you report your own misfiled W-2 form and submit the correct one, the penalty can be much less severe than if the IRS has to contact you about the problem. The best thing to do if you need to submit past-due W-2 forms is to be honest about your reason for not submitting them on time. The longer you go without filing the correct forms, the more the IRS will tend to suspect you of evading your taxes or committing tax fraud. Failure to file a past-due W-2 can lead to increased fines that could double the amount you owe or even result in serving jail time.

Steps for Filling Out the W-2 Form 2016

As long as you have kept accurate records for your employees, filling out a W-2 form is a simple matter of plugging in the correct numbers in the appropriate boxes. You can get an official multi-copy W-2 form packet easily from the IRS.

- All entries must be typed in black ink and in 12-point Courier font, as machines won’t recognize colored, italicized, script or handwritten entries.

- Copy A must not contain any errors, cross-outs, erasures or whiteouts. You must mark the Void box with an X in the event that you make a mistake and start over on the next W-2 form provided.

- Omit the dollar sign and all commas from entries, but always include decimal points. Even if the cents amount is 0, you must still end the number with .00.

- The entire Copy A page must be sent to the SSA. This page is printed with red ink. Form W-2 has two forms on one page, and you must submit the entire page even if one of the forms is void or blank.

- Leave blank any boxes that don’t apply to the employee. Don’t cross them out or mark on them in any way.

Quick Questions

Resources:

https://www.irs.gov/forms-pubs/about-form-w2

https://www.forbes.com/sites/kellyphillipserb/2016/01/27/understanding-your-tax-forms-2016-w-2-wage-tax-statement/#25b70d673bf2

https://www.irs.com/articles/penalty-for-failing-to-file-past-tax-returns