Freelance Contract Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Freelance Contract with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Freelance Contract with PDFSimpli.

Pick from the colors and templates below

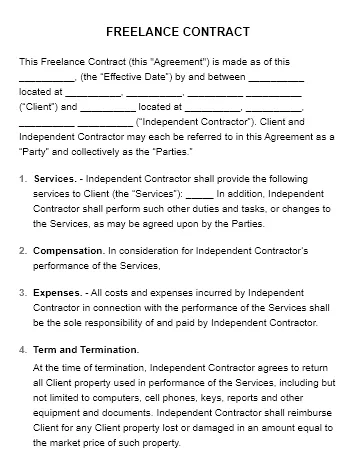

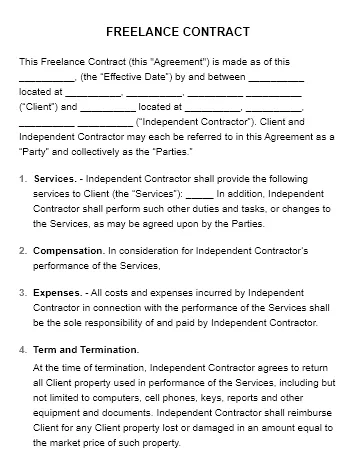

Some companies use independent contractors for projects instead of standard, full-time employees. Companies turn to freelancers to help them take on temporary projects or when they need specific services that their regular employees can’t perform. Because of the nature of independent contract work, there is a need for an official document that details the arrangement, usually in the form of a formal contract. A freelance contract documents the details of the project between the organization and the freelance independent contract worker. Freelance contracts can be prepared by either the company or the freelancer. Having a contract prepared before the project begins is an excellent way to set expectations and ensure the work relationship will be smooth and free of problems.

A comprehensive freelance contract should detail the scope of the work or project that the freelancer is going to complete. It should also document the amount of time the work should take place or indicate if the project work is on an as-needed or periodic basis. Most freelance contracts also contain information about the freelancer’s payment terms for the work. The contract may also have information regarding the tax implications of working as an independent contractor. Some companies also include additional legal language regarding the nature of the working relationship between the freelance contractor and the organization.

A freelance contract is used when an organization or employer has a one-time project or job that needs to be completed by people with special sets of skills. These contracts are used with freelance workers who aren’t employees of the organization and don’t come into the office on a regular basis. Freelance contracts may cover a specific period of time for a project, such as a few weeks or months.

Freelance contracts protect both the freelancer and the business from possible issues or disputes. The contract terms dictate a clear timeline for the project, the payment amount, payment schedule, and the scope of the freelancer’s duties. The contract helps set up specific expectations for both parties and gives them both a way to get what they want out of the business relationship.

Without a formal freelance contract set in place, freelancers may appear unprofessional and could be taken advantage of by businesses. Additionally, on the business side, working with a freelance contractor without an agreement in place could cause delays on the project and higher costs. It may also be problematic for tax purposes if there is no evidence the contractor wasn’t a regular employee. There are tax benefits when using an independent contractor, but businesses must follow the procedures to show a freelancer isn’t a standard employee.

Before writing a freelance contract, a business must connect with a skilled freelance worker. Some freelancers have a standard freelance contract template they use before beginning each project, and in other cases, the business is the party that prepares the freelancer contract. Once the parties have agreed to work together, they must decide on the terms of the independent contractor agreement. They must plan a timeline for the work and what the freelancer’s duties will be. The freelancer’s payment terms for working on the project must also be determined before writing out the contract. Then, the parties can work together to draft a freelance agreement with the agreed-upon terms. The written contract may be for a work product such as a piece of writing, photography, web site building, building repairs, artwork, and many other services.

Here are some things to consider including in a freelance contract:

A freelance contract is most often written and prepared by a business or organization seeking an independent contractor for a project. First, the business must determine the scope of the project and what duties will be required. The company must also figure out the schedule for the work they want to be completed. Once the company has chosen a freelancer to take on the project, they must negotiate the fee and how it will be paid out. The business must also determine what other things they need to include in the contract to ensure the freelance work aligns with independent contractor tax rules.

It’s best to choose a software program that gives businesses the power to draft and edit documents seamlessly. PDFSimpli helps organizations prepare a freelance contract fast and process the document easily so work can begin right away on an important project. This program also allows for electronic collaboration and simple editing when there are changes to the terms of the contract during the drafting process.

The point of contact for the business project can then start working on preparing the freelance contract by filling it out with PDFSimpli’s intuitive formatting tools. There are suggested outlines and examples of wording for this type of document to make the writing and editing process much more manageable.

After writing, the organization should review the document to make sure it meets all of the project’s requirements. The software makes it possible for multiple people in the company to look at and collaborate on the freelance contract as well.

The final stage in the contract writing process is saving, downloading, printing and signing. After saving and downloading, the freelance contract can be printed out for the organization’s files and tax forms. It can also be sent electronically to the freelance worker so each party has a copy. Each party must also sign the contract for it to be official.

A freelance contract is used for independent contractors and doesn’t include benefits, health insurance, a salary, sick days, pensions or vacation days. A standard employee contract is for a worker that is officially hired by the company. The business pays employment taxes for this type of worker, while independent contractors pay their own employment taxes. An employee contract may include a job description and the scope of a person’s duties at the company. A freelance contract may also allow a freelancer to use their own materials, equipment, employees and other resources to complete a project.

Some freelance contracts have language in them detailing what happens if the contract needs to be terminated. There should be a clause in the contract allowing for a notice period the freelancer or the business is required to give if the contract must be terminated. Some contracts may also include penalties for terminating the contract.

Most freelancers enjoy the freedom of taking on as much work as they can handle, and this includes doing projects for multiple clients. In some cases, there may be non-compete clauses in a freelance contract to prevent freelancers from doing similar work with the company’s competitors. Freelance workers must also advocate for themselves if they want to have the flexibility to work on other projects while completing their assignments.