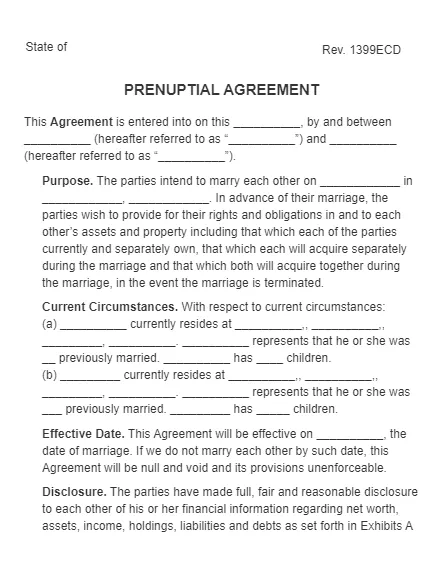

Prenuptial Agreement Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Prenuptial Agreement with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Prenuptial Agreement with PDFSimpli.

Pick from the colors and templates below

A couple may choose to create a prenuptial agreement, also known as an antenuptial agreement before they get married in order to legally designate what happens to their financial property in the event that they divorce. Those money matters typically cover income, investments, properties, inheritances, and other marital property, as well as any debt jointly acquired by the couple during their marriage. Spousal support or alimony is commonly outlined in a prenuptial agreement as well. Child custody and support are not.

While pop culture often depicts the prenup as something only the wealthy need, in reality, virtually every couple can benefit from clearly defining their assets, as well as what will happen to them if the couple parts ways. As more and more men and women decide to marry later in life – after having careers, children, and even previous marriages – signing a prenuptial agreement is becoming an increasingly commonplace part of the marriage process. It’s an opportunity to create financial transparency with the future spouse, safeguard business assets, and protect family assets while the partners are on excellent terms.

There’s also a misconception that signing a prenup expresses a lack of faith in the marriage. This isn’t necessarily true. Without a prenuptial agreement, the state determines how your assets are split after a marital dissolution, and different states follow different laws with regards to community property. With a prenuptial agreement in place, you and your partner control those decisions yourselves in the manner that best suits your family.

A prenuptial agreement allows each spouse in a marital agreement to protect his or her money, property, and other assets. Because it’s usually created while the couple is engaged, it also results in level-headed decision-making, as a couple entering a marriage typically communicates better than a couple exiting a marriage.

With a prenup, each partner can safeguard individual assets, guarantee the financial stability of any children from previous relationships, and avoid getting stuck with any debt his or her spouse may have brought into the union. A prenuptial agreement must be made in writing to be enforceable; for example, it’s not enough to verbally agree that your partner’s college loans will be always his or her responsibility and not yours.

A prenuptial agreement allows you and your partner to control what happens to your assets if you divorce. Without it, the state makes those decisions. What’s more, by drafting the document when you’re on good terms, you can ensure that the choices you and your partner make are in good faith, unclouded by negative feelings.

While every couple can benefit from having a prenup, it’s particularly smart for individuals who:

Have children from a prior marriage

or relationship

Stand to inherit a large sum of money

Enter the marriage much wealthier than their partner

Own a business

Plan to either support or be supported by their partner as they earn a college degree

Want to protect any particularly valuable investments or property

Since a prenup is so specific to a couple, the information necessary to write it can vary greatly. Among other requirements, you typically need to establish the division of property. This is typically done using percentages. Overall, a prenup can include many details:

All prenups require the following:

The legal names and addresses of both members of the couple

The date and location of the wedding

The state in which you will reside after marrying (which may be different from where the wedding takes place)

The names and signatures of up to two witnesses (varies by state)

The seal and signature of a notary public

Additional items may be addressed in the document:

Debts (how much and to whom or what)

Dependent children (names and ages)

Child support terms

Property

Pets, which are often treated as property

When listing property, you must include enough identifying information about it to make it clear which item or items you’re referring to:

Real Estate: type of property and address

Vehicles: Make, model, year and VIN

Accounts: account type, account number and institution

For all other property, be as descriptive as possible: “Sapphire ring from Andersen Jewelers,” “abstract warrior sculpture by J. R. Sarpino,” “bleacher seats from original Comiskey Park”

1 What is a Prenuptial Agreement?

2 What is a Prenuptial Agreement used for?

3 Why should you use a Prenuptial Agreement?

4 How to write a Prenuptial Agreement?

5 How to Fill Out a Prenuptial Agreement with PDFSimpli in Five Steps

6 Prenuptial Agreement Frequently Asked Questions

>6.1 Can you get a prenuptial agreement after you’re already married?

>6.2 Is a prenuptial agreement the same thing as a cohabitation agreement?

>6.3 Can you void a prenuptial agreement?

You can. This is typically referred to as a postnuptial agreement or post nuptial agreement. That said, most experts recommend signing your prenup before your wedding, ideally no later than a month before the big day. This helps the document stand up better in court because it suggests that both parties had plenty of time to think things through before signing and neither was coerced or forced to sign under duress.

No, a prenup is strictly for couples who plan to legally wed. A cohabitation agreement is for couples who plan to live together but not get married. Both serve essentially the same purpose, though, as each type of document is designed to help both partners in the relationship protect their assets, as well as those of their existing children and other family members.

In certain cases, you can. Generally speaking, if the prenup wasn’t drafted correctly or signed with undue influence, it can be voided. This might happen in instances such as the following: