Form4506t Template

Stop searching and find out why people love the ease of creating beautiful and legally compliant Form4506t with PDFSimpli.

Stop searching and find out why people love the ease of creating beautiful and legally compliant Form4506t with PDFSimpli.

Pick from the colors and templates below

The 4506 T form is a document requesting a transcript of your tax return. The IRS offers several types of transcripts to taxpayers, including return transcripts, tax account transcripts, record of account transcripts, wage and income transcripts, and verification of non-filing letters. You can use form 4506 T to request any of these documents, and you need to fill out one form per request.

What makes the 4506 T different from IRS Form 4506? Well, Form 4506 is used to request an actual copy of your complete tax return. On the other hand, Form 4506 T lets you request a transcript of your tax return. Transcripts contain the most important information from a return, but they’re not photocopies. They’re summarized documents with line items for details such as your adjusted gross income (AGI).

You can use the 4506 T form to request a tax return transcript for the most recent year or the previous three tax returns filed. A simpler account transcript is available for older tax returns. You can request up to four years of tax return information at the same time with Form 4506 T. There is no cost to obtaining these transcripts from the IRS.

The 4506 T form is used to request a transcript of your tax return in many situations:

Lenders need to verify your income with a tax return transcript.

Some real estate agents want proof of income before working with you.

The Small Business Administration requires a tax return transcript for business loans.

Many universities require a transcript to approve financial aid.

A transcript can show you the estimated tax payments you’ve made before filing your tax return.

The IRS has an online option for requesting tax return transcripts, but signing up for an account isn’t always easy. To use the online option, you have to include the following information: your social security number (SSN), date of birth, mailing address, email account and mobile phone number. You also need to list the account number of a personal credit card, car loan, line of credit or mortgage. If you don’t meet those requirements, you can fill out and send Form 4506 T instead to get the tax return transcript you need.

Without a transcript of your tax return, qualifying for a loan is virtually impossible. Lenders don’t take your word for it when it comes to the amount of money you make in a year. The same thing goes for college financial aid applications. A tax return transcript lets interested parties verify the income information you put on your application.

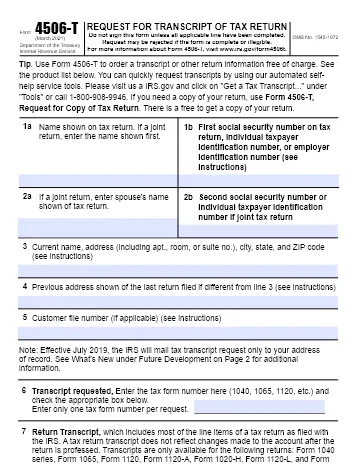

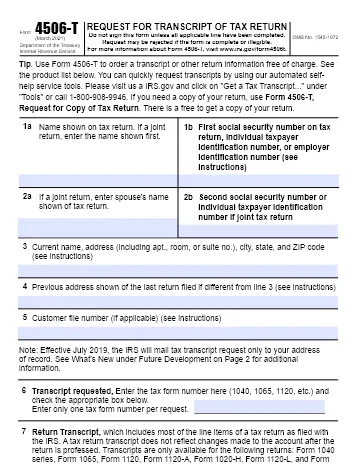

Here are the most important parts of Form 4506 T and what they mean:

Put your name (and spouse’s name for joint filing) as it appears on your tax return.

Write your SSN, individual taxpayer identification number (ITIN) or employer ID number. For joint filing, include your spouse’s SSN or ITIN.

Put the street address for your residence, including city, state and ZIP code.

Write the tax return form you filed. Individual returns use Form 1040, 1040EZ or 1040A.

Put the ending dates of up to four periods of tax returns that you want a transcript for.

Check the box next to the type of tax return transcript you’re requesting. Keep reading to learn more.

This is a transcript of the information on your original tax return. It shows your adjusted gross income (AGI) and related schedules. It doesn’t include changes.

For basic information, such as taxable income and AGI, this simplified transcript may be best.

This document offers the most complete tax return info. It’s preferred for many needs.

This document can confirm that you haven’t filed a tax return for the year requested.

This transcript covers wage forms such as W-2s and 1099s.

Filling out the 4506 T form isn’t complicated when you have the necessary information on hand. If you’re requesting a tax return transcript for your own records or accounting purposes, you primarily need ID numbers. If you need a transcript to submit along with a loan application, it’s helpful to ask lenders what type of tax return transcript they prefer. That way, you can avoid delays and send the correct information right away.

Filling out the 4506 T electronically gives the document a professional appearance. It also saves you time. You can type the information into each field from your laptop, computer or smartphone. LegalSimpli makes it easy to fill out Form 4506 T quickly and correctly. With LegalSimpli, you don’t have to worry about redoing the entire form because of an accidental typo. You can just correct the information and create your document in minutes.

Once you have the necessary information (SSN, etc.) and you know what kind of tax return transcript you want, and the years you need, you’re ready to complete the 4506 T form online using LegalSimpli. Use the Text Tool to fill in all applicable fields. Click on the Check Mark Tool to place a mark in boxes.

Carefully check the information to ensure it’s correct. Otherwise, the IRS won’t accept Form 4506 T and you’ll need to send another. This form isn’t long, so reviewing it only takes a minute.

Once you’ve filled out and reviewed your Form 4506 T, click on the Save button. This allows you to save your completed form in your account. Then, you can download it to your computer, save a copy in the cloud or print it out. To sign the form electronically, use LegalSimpli’s helpful eSignature feature. Then, mail or fax the 4506 T form to the IRS office address listed at the bottom of the form.

It takes 2–4 weeks for the IRS to process electronic tax returns. Mailed tax returns can take up to 6 weeks for processing. If you’re having trouble getting the tax return transcript for the current year, you may just need to wait a little longer before sending form 4506 T. Also, you won’t be able to request a transcript until the IRS has received the complete amount of taxes owed for the year.

The IRS will only send your tax return transcript to the address listed on your last tax return. If your mail isn’t being forwarded to your new address, or you don’t want to risk strangers getting ahold of your tax info, you should notify the IRS of your new address right away. Use Form 8822, Change of Address for this. You may need to wait 4–6 weeks for the new address to show up before sending the 4506 T form.

The IRS will only send your tax return transcript to the address listed on your last tax return. If your mail isn’t being forwarded to your new address, or you don’t want to risk strangers getting ahold of your tax info, you should notify the IRS of your new address right away. Use Form 8822, Change of Address for this. You may need to wait 4–6 weeks for the new address to show up before sending the 4506 T form.